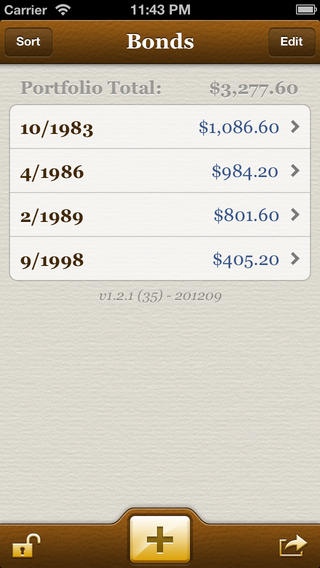

Savings Bond Calculator. If you own or are considering purchasing a U.S. Savings bond, the U.S. Department of Treasury's Bureau of the Fiscal Service has designed a useful tool for determining the present and future value-as well as historical information, current interest rate, next accrual date, final maturity date, and year-to-date interest. Savings Bond Calculator for Paper Bonds. Note: The Calculator is for paper bonds only. To learn the value of your electronic savings bonds, log in to your TreasuryDirect account. Find out what your paper savings bonds are worth with our online Calculator. The Calculator will price paper bonds of these series: EE, E, I, and savings notes.

Want to see how long it will take you to save up for a down payment on a home?

This calculator will estimate how long you need to save to reach your down payment savings goal. Enter the current house price, the down payment percent you want to pay, an estimate of rate of appreciation for local real esate, how much you already have set aside, how frequently you plan to add deposits, the amount of your deposits, and the interest rate you expect to earn on your savings.

The calculator will automatically update the results when you change any of the input fields. Home price changes, interest earned & total savings are compounded each time a deposit is made. We also offer a calculator that converts rent payments into equivalent mortgage payments.

For your convenience we list current local mortgage rates to help homebuyers estimate their monthly payments & find local lenders.

Current Local Mortgage Rates

The following table shows current 30-year mortgage rates available in Los Angeles. You can use the menus to select other loan durations, alter the loan amount, or change your location.

How to Save for a Mortgage Down Payment

If you are not yet a homeowner but wish to be one someday, you are going to have to consider a down payment. Though there are certainly some mortgage options that will allow you to get into them without a down payment (like the VA loan, which caters to veterans), these are much more the exceptional cases than the general rule for most home buyers. Workers in influential technology companies with valuable stock options might also be able to bypass saving for a down payment, but this is guide which applies to most of the country.

This article is meant to help you start thinking more clearly about a mortgage down payment: how much you might need, how it affects your mortgage and more. As with all financial decisions, please consult a trusted financial advisor before making any serious move forward.

What is a Typical Mortgage Down Payment?

As there are different types of mortgage options, there are also a range of required down payment amounts to accompany them. Expect to pay from 0-20%, or possibly even more.

Traditionally, 20% was the goal for a mortgage’s down payment but that has shifted some in recent years as lenders and government sponsors get more creative with their offers.

If you are arranging your mortgage through a government entity, such as with a VA or an FHA loan, you could reduce your needed down payment to 3.5% with an FHA, or even zero-down if you are veteran, qualified for the VA loan.

Conventional mortgages usually require a minimum of 5% down, but it will range and vary by provider and the options offered for your specific qualifications.

Freddie Mac now has Home Possible, and Fannie Mae offers HomeReady which are programs created in 2018 with low down payment requirements – only 3-5%.

Factoring in all of the various loan types and programs available, an averaged median cost for a mortgage down payment would currently fall between 5-10% of the full mortgage amount. The optimum down payment is still 20% or more, but lower rates are very common today.

Is Lowest Always Best?

While paying less money to get into a mortgage certainly sounds attractive, it is important to understand how the decision can affect other related aspects of your mortgage's costs.

- Fees: When you pay 5% or less as a down payment, your lender is likely going to leverage additional fees to help mitigate their risk. Some may even bump up your interest rate – so be fully aware of the fees and contingencies based on each decision you make. It is not uncommon for a lender to leverage large fees for each ‘discount’ offered. You should know what each fee is for before signing any loan contract. You should know the difference between discount points, origination points, and other common industry lingo.

- PMI: When you pay less than 20% down, most mortgage providers require Private Mortgage Insurance (PMI) until your loan balance achieves 80% of the home’s original value. PMI fees range between about 0.3-1.5% of the original loan amount annually and are added to your monthly payments. A down payment of 20% negates the need for PMI, so that is why 20% is typically the targeted down payment amount.

Lenders have also become pretty creative in the way they can structure loans, giving more opportunity to folks who have less money up-front to get into a home. One such option, designed to assist cash-strapped borrowers, was the piggyback mortgage of the mid-late 2000's, still used occasionally today.

A Note on Property Mortgage Insurance

Those who pay at least 20% on a home do not require PMI, but homebuyers using a conventional mortgage with a loan-to-value (LTV) above 80% are usually required to pay PMI until the loan balance falls to 78%.

PMI typically costs from 0.35% to 0.78% of the loan balance per year. The annual payment amount is divided by 12 and this pro-rated amount is automatically added to your monthly home loan payment.

| Home Price | Down Payment | LTV | Loan Amount | Insurance Rate | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|

| $200,000 | $10,000 | 95% | $190,000 | 0.78% | $1,482 | $123.50 |

| $200,000 | $20,000 | 90% | $180,000 | 0.52% | $936 | $78.00 |

| $200,000 | $30,000 | 85% | $170,000 | 0.35% | $595 | $49.58 |

| $200,000 | $40,000 | 80% | $160,000 | not required | $0 | $0 |

Median Home Prices & Common Down-payment Amounts Across the US

Here are a range of down-payment amounts for median homes across the country. The average amount financed is 90%, so the average down-payment on a median existing home is $23,600 while the average down-payment on a median new home is $38,820. Closing costs are not included in these figures.

| March 2017 Price | 3% | 5% | 10% | 15% | 20% | |

|---|---|---|---|---|---|---|

| Median Existing Home | $236,400 | $7,092 | $11,820 | $23,640 | $35,460 | $47,280 |

| Median Existing Single-Family Home | $237,800 | $7,134 | $11,890 | $23,780 | $35,670 | $47,560 |

| Median Existing Condos & Co-ops | $224,700 | $6,741 | $11,235 | $22,470 | $33,705 | $44,940 |

| Median Existing West Home | $347,500 | $10,425 | $17,375 | $34,750 | $52,125 | $69,500 |

| Median Existing Northeast Home | $260,800 | $7,824 | $13,040 | $26,080 | $39,120 | $52,160 |

| Median Existing South Home | $210,600 | $6,318 | $10,530 | $21,060 | $31,590 | $42,120 |

| Median Existing Midwest Home | $183,000 | $5,490 | $9,150 | $18,300 | $27,450 | $36,600 |

| Median New Home * | $315,100 | $9,453 | $15,755 | $31,510 | $47,265 | $63,020 |

| Average New Home * | $388,200 | $11,646 | $19,410 | $38,820 | $58,230 | $77,640 |

Sources: * Census.gov, all others NAR

Quickly Estimating Down-payments

Rules of thumb for quickly estimating down-payment amounts:

- 10% down: remove the far right number from the home's price

- 20% down: take the 10% number & double it

- 5% down: take the 10% number & divide it by 2

The above rules of thumb will skew slightly low because they do not include closing costs, which typically run between 2% to 5% of the home purchase price.

How Much Money Should I Save for a House?

The more you can afford to put down on a house the less capital will accumulate interest. Further, outside of saving on interest payments, there is another benefit for putting down at least 20%.

For a standard conforming mortgage, it is ideal to put at least 20% down on the loan. Loans which have less than 20% down-payment have a loan-to-value (LTV) above 80% & are required to carry property mortgage insurance (PMI), which is an additional expense paid by the home buyer to insure the lender will get paid in case the homeowner can not make payments. These insurance payments must be made until the LTV falls below 80% & are automatically removed when the LTV falls to 78%.

PMI ranges from 0.3% to 1.5% of the initial loan amount, with the consumer's credit score & the down-payment amount factoring into the rate.

Piggyback Mortgages

If you do not have the 20% down needed to avoid PMI on a second mortgage, lenders have devised a new loan structure to help you get some of these benefits: the piggyback mortgage.

Buyers may apply for a second mortgage to help pay part of their down-payment & remove PMI insurance requirements. This loan format is often referred to as a 'piggyback loan,' where a borrower pays 10% down on the home & uses the second mortgage for the next 10% down to avoid PMI payments.

Where a typical mortgage might be seen as 20-80, with 20% down and 80% financed, a piggyback mortgage splits the down payment into pre- and post- fees, structuring the same amount as 10-80-10 (or maybe 5-80-15, or 15-80-5), with only 10% (or 5% or 15%) needed down, then the additional percentage financed as a different part of the same loan, but a different loan as well…usually at a higher interest rate.

So, you would be making two mortgage payments with a piggyback – one for the mortgage, and one for the down payment – the 80% and that 10% at the end of the equation. But you would need less cash up-front to close.

- The power of this deal lies within the borrower's ability to leverage a lower amount in, and an ability to finance half of the down payment.

- The chief drawback to this kind of deal, is that the second portion of the financing will carry a significantly higher APR – often making this a more expensive option unless you make extra payments.

Losing the costs of PMI will need to be offset by the strategy of a piggyback – maybe by paying off the smaller loan quickly, or this type of loan will not make long-term sense.

While it can help you to get into a bigger home with less money up-front, if you are not careful, a piggyback can actually make you pay MORE for the home in time, than other options would…because the inflated interest rate on the second mortgage could be significant, increasing your bottom line spend for the property.

Should you piggyback? Maybe so, if these are true:

- If you are lacking down payment funds, it makes sense to exhaust all options.

- If you could potentially pay off the smaller loan early, you could certainly benefit from a lack of PMI…but weigh-out the rates and terms to see it all, clearly, to be sure.

Example Monthly PMI Costs

Here is a chart of estimated monthly PMI costs based on a rate of 0.55%.

| March 2017 Price | 3% down | 5% down | 10% down | 15% down | 20% down | |

|---|---|---|---|---|---|---|

| Median Existing Home | $236,400 | $105 | $103 | $98 | $92 | $0 |

| Median Existing Single-Family Home | $237,800 | $106 | $104 | $98 | $93 | $0 |

| Median Existing Condos & Co-ops | $224,700 | $100 | $98 | $93 | $88 | $0 |

| Median Existing West Home | $347,500 | $154 | $151 | $143 | $135 | $0 |

| Median Existing Northeast Home | $260,800 | $116 | $114 | $108 | $102 | $0 |

| Median Existing South Home | $210,600 | $94 | $92 | $87 | $82 | $0 |

| Median Existing Midwest Home | $183,000 | $81 | $80 | $75 | $71 | $0 |

| Median New Home * | $315,100 | $140 | $137 | $130 | $123 | $0 |

| Average New Home * | $388,200 | $173 | $169 | $160 | $151 | $0 |

Sources: *Census.gov, all others NAR

PMI Payments, 30 Year Conventional Mortgage

Years to build 22% equity (& remove PMI payments) for a 30 year conforming loan, based on down-payment amount & loan interest rate.

| Down-payment | 0% | 5% | 10% | 15% |

|---|---|---|---|---|

| APR | Years of PMI payments | |||

| 3% | 8.5 | 7.5 | 6 | 4 |

| 4% | 9.5 | 8.5 | 6.5 | 4.5 |

| 5% | 10.5 | 9.5 | 7.5 | 5 |

| 6% | 11.5 | 10.5 | 8.5 | 5.5 |

| 7% | 12.5 | 11.5 | 9 | 6.5 |

| 8% | 13.5 | 12 | 10 | 7 |

| 9% | 14.5 | 13.5 | 11 | 8 |

| 10% | 15.5 | 14.5 | 12 | 9 |

PMI Payments, 15 Year Conventional Mortgage

Years to build 22% equity (& remove PMI payments) for a 15 year conforming loan, based on down-payment amount & loan interest rate.

| Down-payment | 0% | 5% | 10% | 15% |

|---|---|---|---|---|

| APR | Years of PMI payments | |||

| 3% | 3.5 | 3 | 2.5 | 1 |

| 4% | 4 | 3.5 | 2.5 | 1.5 |

| 5% | 4 | 3.5 | 2.5 | 1.5 |

| 6% | 4 | 4 | 3 | 2 |

| 7% | 4.5 | 4 | 3.5 | 2 |

| 8% | 5 | 4.5 | 3.5 | 2.5 |

| 9% | 5 | 4.5 | 3.5 | 2.5 |

| 10% | 5 | 5 | 3.5 | 2.5 |

If the value of your home increases significantly during the loan, you may be able to get PMI removed quicker than shown in the above charts if the bank recognizes the increased value of your home. To do so, you will have to contact your lender when your LTV is below 80% to request the removal of PMI.

Can You Buy a Home With Low (or No) Money Down?

It is possible to buy a home with little or no money down, however the ability to do so depends on how tight lending standards are, the background of the applicant & the credit quality of the applicant. Some programs are available exclusively to military members, low income communities & first time home buyers.

Conventional 97 Mortgages

Typical banks want at least a 3% down-payment & PMI to insure loans. Loans with a 3% down-payment are called Conventional 97 mortgages.

HomeReady

Fannie Mae has approved mortgage lenders to offer a HomeReady lending program that only requires a 3% down-payment. The program can be used by first-time & repeat home buyers to finance or refinance a home in lower-income & minority-heavy areas. The minimum credit score for HomeReady loan qualification is 620.

Home Possible Advantage

Freddie Mac offers 2 low down-payment mortgage options.

Their Home Possible program requires a 5% down-payment & can be used on most types of property using a variety of fixed & adjustable rate loan terms.

Home Possible Advantage requires a 3% down-payment, but can allow up to 105% financing when combined with a second mortgage. These can only be applied to fixed-rate mortgages on primary residences.

Federal Loan Programs

Some federal loan programs may come with the ability to buy a home with little to no money down.

- VA loans do not charge PMI & do not require a down-payment. Active duty military members and veterans are able to access competitive mortgage rates where the loans are insured by the federal government.

- The USDA's Rural Development loans do not require a down-payment.

- FHA loans typically have a large upfront fee rolled into the loan if the buyer either chooses a 15 year loan or puts less than 22% down on the loan. This fee can be more expensive than PMI, but can save borrowers with poor credit profiles significant money. And after the loan has been regularly paid for years a borrower could choose to refinance into a regular conforming mortgage. FHA loans allow credit scores as low as 500 & only requires a 3.5% down-payment.

What is the Average Down-payment on a House?

Cash Buyers

All-cash buyers represent a small segment of the overall home buying market.

Ee Savings Bond Calculator Free

Traditionally most home buyers in the United States have financed their home purchases. According to the National Association of Realtors, in 2016, 88% of home buyers used mortgage financing.

Before many cash-rich buyers from China & other countries purchased escape hatch homes the percent of buyers leveraging financing has historically ranged between 92% & 93%.

Loan Product

A big part of what controls the average down-payment largely comes down to what loan programs are popular at the time. For example, in 2013 the FHA significantly increased fees associated with their loan programs, which in turn has made conventional mortgage loans relatively more attractive & increased the market-share of conventional loans.

Here is the breakdown of buyers by financing type.

| Mortgage Type | % of buyers in 2016 |

|---|---|

| fixed | 92% |

| adjustable | 8% |

| conventional | 59% |

| FHA | 24% |

| VA | 12% |

Demographic Mortgage Data

| Generation | Used Financing | Down-payment | Amount Financed |

|---|---|---|---|

| Gen Y | 98% | 7% | 93% |

| Gen X | 96% | 10% | 90% |

| Baby Boomers | 76% | 17% | 83% |

| Silent Generation | 58% | 22% | 78% |

| Overall | 88% | 10% | 90% |

While a 20% down-payment is a popular benchmark, some borrowers can borrow up to 97% of a home's value with property mortgage insurance, while others leverage federal programs with no down-payment requirements. One of the primary determinants of the percent financed is how old the home buyer is. Here are 2016 home financing statistics based on the age of the home buyer.

| All Buyers | < 37 | 37 - 51 | 52 - 61 | 62 to 70 | 71 to 91 | |

|---|---|---|---|---|---|---|

| Less than 50% | 9% | 6% | 5% | 10% | 19% | 20% |

| 50% to 59% | 4 | 1 | 4 | 3 | 7 | 11 |

| 60% to 69% | 4 | 2 | 4 | 5 | 10 | 11 |

| 70% to 79% | 11 | 8 | 12 | 15 | 14 | 16 |

| 80% to 89% | 23 | 24 | 24 | 25 | 16 | 22 |

| 90% to 94% | 14 | 18 | 15 | 9 | 10 | 2 |

| 95% to 99% | 21 | 26 | 23 | 17 | 10 | 6 |

| 100% – Financed entire purchase | 14 | 15 | 12 | 13 | 15 | 14 |

| Median percent financed | 90% | 93% | 90% | 86% | 81% | 76% |

Time required to save for down-payment

| All Buyers | < 37 | 37 - 51 | 52 - 61 | 62 to 70 | 71 to 91 | |

|---|---|---|---|---|---|---|

| < 6 months | 40% | 38% | 39% | 48% | 47% | 58% |

| 6 - 12 months | 15 | 18 | 14 | 9 | 8 | 6 |

| 12 to 18 months | 9 | 10 | 10 | 7 | 4 | 3 |

| 18 to 24 months | 7 | 8 | 8 | 4 | 4 | 2 |

| over 2 years | 29% | 24% | 27% | 30% | 35% | 31% |

Lender Rejections of Borrowers

| All Buyers | < 37 | 37 to 51 | 52 to 61 | 62 to 70 | 71 to 91 | |

|---|---|---|---|---|---|---|

| Have had application denied | 5% | 5% | 6% | 7% | 3% | 4% |

| Median number of times application was denied | 1 | 1 | 1 | 1 | 1 | 2 |

| Debt to income ratio | 15% | 18% | 20% | 13% | 9% | 7% |

| Low credit score | 14 | 14 | 22 | 16 | 3 | 3 |

| Income was unable to be verified | 6 | 4 | 12 | 10 | 3 | 7 |

| Not enough money in reserves | 4 | 3 | 7 | 3 | 1 | 6 |

| Insufficient downpayment | 3 | 4 | 4 | 4 | 3 | |

| Too soon after refinancing another property | 2 | 1 | 2 | 6 | 4 | |

| Other | 54 | 60 | 36 | 57 | 68 | 67 |

How to Save Smartly

Assuming you are looking at different saving options to try to build-up enough cash to make a down payment, which one will typically pay-off the fastest?

Savings Account

High-yield savings & money market accounts frequently offer under 1% APY while rarely going much above 2% APY (annual percentage yield).

Certificates of Deposit

CDs tend to offer slightly higher rates than high-yield savings accounts depending on their duration. Since the 2008 Great Recession these have rarely yielded much more than 2.5.-3.25% APY.

Bonds

Government bonds typically pay 1% to 3.5% depending on duration, with longer durations paying higher yields. Some municipal bonds are tax free. Corporate bonds typically offer higher yields than similar duration government bonds with the yield spread premium depending upon broader market conditions and the creditworthiness of the borrower.

High Yield Dividend Stocks

High yield stocks can pay anywhere from 3% to 6% per year dividend income, with that number growing over time as dividends are reinvested. Some highly speculative plays tied to cyclical commodities may offer higher yield, though higher yields are often associated with a higher level of risk of either a dividend cut or a fall in share price.

Exxon Mobil paid $3.48 in dividends in 2020, though their share price fell from over $70 at the begining of the year to a low of $30.11 as the COVID-19 crisis swept the globe then Saudi Arabia and Russia increased production in the face of declining global oil demand. Share price volatility does not matter as long as you can ride it out for many years, but a $3.48 dividend would take over a decade to pay for the above share price decline & that is before you account for income taxes on the dividends.

The 2010s decade was one of the worst decades for value stocks in the history of the markets as many offline activities moved online & things like bank branch network and expensive retail stores are devalued by online apps and ecommerce. In the 2020s interest rates are likely to rise at some point, which could cause a shift away from growth toward value.

Sure Dividend offers newsletters and an advisory service to help investors buy into companies they deem stable. There are also high-dividend ETFS like NOBL which allow investors to quickly buy a broad-basket exposure to Dividend Aristocrats.

Broad stock market index

Historically the American stock market has returned 5% to 10% APY with dividend reinvestment, depending on strategy, with risk of significant drawdowns that frequently happen around recessions. Keeping management fees low is crucial to maximize wealth compouding. Most day traders lose money due to selling winners to soon, holding losers too long, and letting their emotions get the best of them. The American stock market is increasingly skewed toward growth rather than value with many large technology stocks making up a big portion of the S&P 500 index.

As you can see clearly, the stock market is where you will earn the most, over time. However, the stock market is full of risks – risks that are clearly diminished in the other options. A CD has less risk, and a savings account sees almost no risk at all to earn its nominal gains. The market, comparatively, fluctuates more often and dramatically than the other investment options will.

Assuming you have a little extra income to save, you will want to find the best possible return for your investment/savings plans. However, this is going to align pretty directly with your aversion or attraction to risk…a higher propensity to risk allows you to gamble more with stocks, less so, and you'll lean harder into CDs and savings accounts.

You certainly may earn more, faster in the stock market, but it is less certain than the other options. The right answer for most people is a balance of assets spread across multiple asset classes.

How Long Do I Have to Save for a Mortgage Down Payment?

Calculator

According to consumer numbers culled by the Bureau of Labor Statistics (BLS), people in different age groups will tend to save money at different rates.

By their findings, Millennials save an average of $7,624 annually, while Gen-Xers save $12,347. Their data did not accurately reflect Baby Boomers, for it was comparing income to savings and many older boomers did not have a regular income flow to use.

Depending on the size of the down payment, you can do simple math to see how long it might take to save for a down payment. As a Millennial, you are probably looking around five years of saving to get 10% for a moderately priced home today, while a Gen-Xer might take closer to three. It is assumed that Baby Boomers will have more savings and could likely save the money in more like two years' time.

It is important to know all your options, such as piggyback loans, government programs and even the new, historically low APR offers from Fannie Mae and Freddie Mac. Set savings goals and be diligent about paying all existing bills on time, in full.

Also keep in mind that the more you are able to save and put down on your home, the better your terms and costs will be at closing. Though you can get into a mortgage with as little as 5% down today, the fees and costs of that loan could dim or diminish its low-cost entry benefits.

Start Today, Be Ready Tomorrow

The important thing to remember about a down payment on a mortgage, is how it will affect the terms of your deal. The larger your down payment, the less risk the lender feels so better terms and lower fees will be the reward.

Us Savings Bond Calculator Download

Home prices in the US are on the rise everywhere, so getting started early on your savings/investing plans is a shrewd move forward. The best news for buyers, could be that lenders are competitive and eager to offer you the lowest possible rates, which are usually lower than they were historically.

Although it was true for a long time that you needed 20% down to get into a mortgage, this is certainly not the case in the modern mortgage landscape. However, be aware of how having a larger down payment will help you to save money: both immediately, and over time.

Talk to a financial planner, start spending more frugally and saving more aggressively, and no matter your age group, you will find a path to home buying success.

Homeowners May Want to Refinance While Rates Are Low

The Federal Reserve has hinted they are likely to taper their bond buying program later this year. Lock in today's low rates and save on your loan.

Are you paying too much for your mortgage?

Find Out What You Qualify For

Check your refinance options with a trusted local lender.

Answer a few questions below and connect with a lender who can help you refinance and save today!

Note: The Calculator is for paper bonds only. To learn the value of your electronic savings bonds, log in to your TreasuryDirect account.

Find out what your paper savings bonds are worth with our online Calculator. The Calculator will price paper bonds of these series: EE, E, I, and savings notes. Other features include current interest rate, next accrual date, final maturity date, and year-to-date interest earned. Historical and future information also are available.

To find what your paper bond is worth today:

- Click the 'Get Started' Link above or the button at the bottom of this page to open the Calculator.

- Once open, choose the series and denomination of your paper bond from the series and denomination drop-down boxes.

- Enter the issue date that is printed on the paper bond. Note: Enter two-digit months (e.g. 01, 12) and four-digit years (e.g. 1985 or 2001). If you're not sure where to find the issue date or serial number of your paper bond, see our bond diagram.

- Click the 'Calculate' button.

To build an inventory of paper bonds:

- Repeat the above process for each of your paper bonds.

- The Calculator will add each new paper bond to the top of your inventory listing.

To find what your paper bonds are worth in other months:

If you'd like to see what your paper bonds were worth in the past or will be worth in the remaining months of the current rate period:

- Change the 'Value as of' date at the top of the Calculator to the desired date.

- Click 'Update'.

- Your inventory will update to show the values or your paper bonds as of the date you enter.

- The Calculator can show you what your paper bonds were worth from January 1996 through the current rate period.

Not sure what data the Calculator is giving you?

If you have questions about any of the fields that are displayed, click the 'Help' button at the top of the Calculator. You'll be taken to our help area where you can find short descriptions of what you're seeing in those fields.

Want to save your inventory?

Note: The Calculator won't save your inventory of paper bonds if you're using either of these browsers: Google Chrome, Microsoft Edge.

You can save your inventory so you can update your paper bond values quickly and easily. All you need to do is use your browser's built-in saving function. Click 'View/Print/Save List' and then when the list appears, click 'File' and 'Save As' and name your inventory. Make sure that you save your file as an 'HTML Only' file and that you know where on your computer's hard drive it will be saved. Then click 'Save.' If you'd like more detail, check out our Instructions for Saving Your Inventory Page. Note: Follow these same steps when re-saving an inventory you've updated.

Need to reopen a saved inventory?

You can open your existing inventory (if you have one) by navigating to the folder or directory where you saved your list using a file management program such 'My Computer' (for Windows users) or the 'Finder' (for Mac OS users). Once you locate your file, double-click it. This should load the file into your web browser where you can click the 'Return to Savings Bond Calculator' button to update the values and continue working with your inventory.

Need to re-save an inventory you've updated?

You must follow the instructions for saving your inventory (above) once you've updated the values or added or removed paper bonds. If you'd like more detail, check out our Instructions for Saving Your Inventory Page.

Note: The Calculator won't save your inventory of paper bonds if you're using either of these browsers: Google Chrome, Microsoft Edge.

If you report interest to the IRS every year as the interest accrues

If you choose to report interest to the IRS annually, check out the Calculator's YTD Interest feature. It reports the amount of interest your paper bonds have accrued from the start of a year through the date you enter in the 'Value as of' section. Here's how you can use this feature to calculate the amount of interest your paper bonds accrued in one calendar year:

- List the paper bonds you want to report annually.

- Enter December of the tax year in the 'Value as of' box. For example, if you want to find the interest your paper bonds accrued in 1999, enter '12/1999' in the 'Value as of' box.

- Find the value in the 'YTD Interest' box. That's the amount of interest your paper bonds accrued that year.